Different Types Of Florida Home Insurance

Florida is a beautiful place to live, with its sunny weather, stunning coastlines, and vibrant communities. However, living in the Sunshine State also means preparing for unique risks like hurricanes, floods, and strong storms. For homeowners, having the right home insurance is essential for peace of mind and financial security. Understanding the different types of Florida home insurance can help you make smart decisions. Choosing the right policy can protect your home, belongings, and family from unexpected disasters. In this article, you will learn about the basics of Florida home insurance, explore standard and specialized policies, and gather tips for finding coverage that fits your needs.

Understanding the Basics of Florida Home Insurance

Home insurance in Florida serves as a financial safety net for homeowners facing unexpected damage or loss. Many policies usually provide coverage for the structure of the home, personal belongings, and liability protection. Because Florida sits in a region prone to severe weather, insurance here carries some unique features. For example, insurance companies offer separate deductibles for hurricane damage, which often differ from other perils. Policies may also exclude certain damages unless you purchase extra protection.

Many Floridians find that standard policies alone may not cover all possible risks. For instance, flooding is not included in most basic home insurance plans. Instead, homeowners may need to purchase a separate flood insurance policy. Understanding what your policy covers and what it excludes remains one of the most important steps in protecting your investment.

Homeowners should also familiarize themselves with insurance terms such as "replacement cost" and "actual cash value." Replacement cost refers to the amount needed to rebuild your home, while actual cash value factors in depreciation. By learning these terms and concepts, you can better evaluate what each insurance policy truly offers. In Florida, knowing the basics will help you avoid costly surprises during times of need.

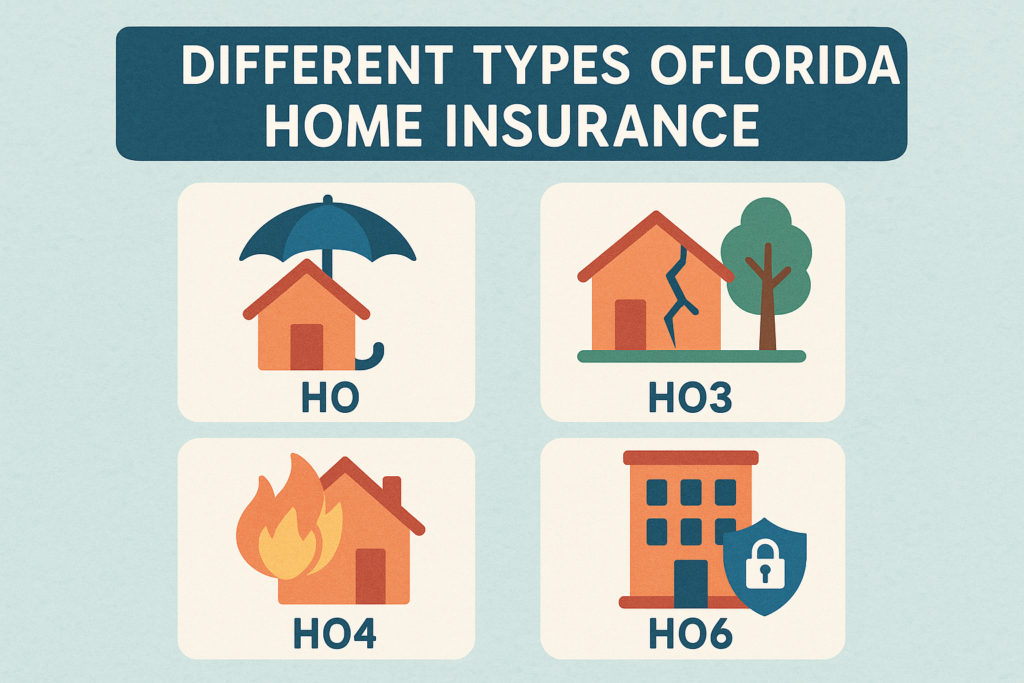

Exploring Standard Homeowners Insurance Policies

Standard homeowners insurance plans in Florida typically follow the HO-3 policy form. This type of policy provides coverage for the home itself against all perils except those specifically excluded. The policy also includes protection for personal property, often covering named perils like fire, theft, and vandalism. Liability coverage offers protection if someone gets injured on your property, which adds another layer of security for families.

Although these policies cover many risks, some important hazards are often left out. For example, most standard plans do not cover flood damage, earthquakes, or certain types of mold. Because Florida faces frequent hurricanes and flooding, homeowners must pay attention to these exclusions. By carefully reading your policy, you can identify gaps and prepare for additional coverage if needed.

When you purchase a standard policy, you also have the option to add endorsements or riders. These extras allow you to tailor coverage for valuable personal items, home businesses, or specific risks. Many insurance companies offer discounts for bundling home and auto policies or installing security systems. Understanding what standard policies include and exclude sets a strong foundation for building a comprehensive insurance plan.

Specialized Insurance Options for Florida Residents

Due to Florida’s unique climate and geography, residents often seek specialized insurance options. Flood insurance stands out as one of the most crucial add-ons, since many areas are flood-prone. While the National Flood Insurance Program offers government-backed protection, private insurance companies are starting to provide more choices. Because standard policies rarely cover flood damage, adding this extra coverage is often necessary.

Another specialized option is windstorm insurance, which covers damages from hurricanes and strong winds. Some areas, especially coastal zones, may require homeowners to buy windstorm insurance as a separate policy. The state of Florida also has Citizens Property Insurance Corporation, a program that serves as a last-resort insurer for residents who cannot find private coverage. Citizens can help those living in high-risk locations secure the protection they need.

Sinkhole insurance is another unique consideration for Floridians. Although sinkholes are rare, certain regions face higher risks, and damage can be devastating. Some standard policies may offer limited sinkhole coverage, but homeowners often need to purchase additional protection. By exploring all specialized options, you can make sure your home is protected from Florida’s most common hazards.

Factors Impacting Your Home Insurance Choices

Many factors influence your Florida home insurance options and costs. The location of your property plays a major role, since homes near the coast or in flood zones face higher risks. Older homes may also cost more to insure, especially if they lack modern building codes or hurricane-resistant features. Insurance companies often consider the construction type, roof shape, and age of the home when determining premiums.

Your claims history can also impact your choices and monthly costs. If you have filed several claims in the past, some insurers may offer higher rates or limited options. Homeowners who invest in upgrades such as impact windows, reinforced roofs, or alarm systems often receive discounts. Regular maintenance and improvements show insurers that your home is less likely to sustain costly damage.

The amount of coverage you choose and the size of your deductible will also affect your premiums. Higher coverage limits mean more protection, but they can increase your monthly payments. Choosing a higher deductible may lower your premium, but it also means you will pay more out of pocket if a disaster strikes. By evaluating these factors, you can make informed decisions that balance affordability and protection.

Tips for Choosing the Right Florida Home Insurance

Shopping for home insurance in Florida requires careful research and comparison. Start by identifying your home's unique risks, such as location, property value, and local weather patterns. Gather quotes from several insurance providers, since prices and coverage options can vary widely. Always ask questions about what the policy covers, what it excludes, and how claims are handled.

Consider working with an independent insurance agent who understands Florida's market. An experienced agent can guide you through complicated choices and help you find discounts. Review the financial strength and customer service reputation of each insurance company before making a decision. In addition, look for companies with a solid track record of handling claims quickly and fairly.

Remember to review your insurance policy every year, especially if you make upgrades to your home. Adjust your coverage when your needs change, such as after renovations or significant purchases. By staying informed, comparing options, and asking the right questions, you can choose a Florida home insurance policy that fits your budget and protects what matters most.

Conclusion

Choosing the right home insurance in Florida involves more than just picking the first policy you find. Because the state faces unique risks from hurricanes, floods, and other natural disasters, careful planning is essential. Evaluating your home's location, age, and construction features helps you understand what kind of coverage you need. Always consider specialized options like flood or windstorm insurance, especially if you live in high-risk areas. Remember that each policy can have exclusions, so reading the details and asking questions is crucial. By comparing quotes and working with knowledgeable agents, you can find affordable protection without sacrificing important coverage. Regularly reviewing your policy ensures you stay prepared for any changes in your circumstances or in Florida’s unpredictable weather. Keeping up with upgrades to your home can also help lower your premiums and keep your coverage up to date. Most importantly, the right insurance gives you peace of mind, allowing you to enjoy the Florida lifestyle without unnecessary worry. By following these guidelines, you can safeguard your home and family for years to come.